VFF Pension’s process for integrating sustainability in capital management

Opt in/Väljer in

In the drive to seek out new investment opportunities, sustainability is an important criterion and VFF Pension looks for fund managers who share the Association’s view of sustainability issues and who meet the Association’s requirements regarding responsible investments. When investing in new funds, VFF Pension obtains information about which ethical criteria the capital manager applies, as well as information about the asset manager’s sustainability process.

Opt out/Väljer bort

In order to reduce any negative impact on its portfolio, VFF Pension opts out of fund managers who do not share the Association’s views on sustainability issues.

Impact/Påverkar

On behalf of VFF Pension, ISS ESG reviews all funds in the overall portfolio based on VFF Pension’s sustainability criteria and responsibilities for its capital management. The review is carried out on the portfolio submitted by VFF Pension on the review date. The various funds’ assets are those most recently registered. In particular, ISS ESG assesses the funds’ assets through norms-based screening, sector-based screening and checking specifically for controversial weapons.

Norms-based screening identifies companies that do not respect international norms governing environmental protection, human rights, labour law or anti-corruption. The check for controversial weapons identifies companies involved in anti-personnel mines, cluster bombs, chemical weapons, biological weapons and nuclear weapons. Sector-based screening identifies companies where 5 % or more of their turnover can be related to the production of pornography or tobacco.

The framework of the ISS ESG review includes dialogue with companies that are assessed as violating norms governing environmental protection, human rights, labour law or anti-corruption. The purpose of this dialogue is to collect relevant facts so as to ensure a comprehensive and objective analysis. ISS ESG seeks to identify how the company takes responsibility for specific violations, and also how the company works preventatively to avoid future violations. In addition, VFF Pension conducts active dialogue with fund managers primarily to persuade such companies to make relevant changes rather than exclude them. In cases in which persuasion does not have the desired effect, VFF Pension may opt to exit the fund.

Here you will find all our Sustainability-related documents

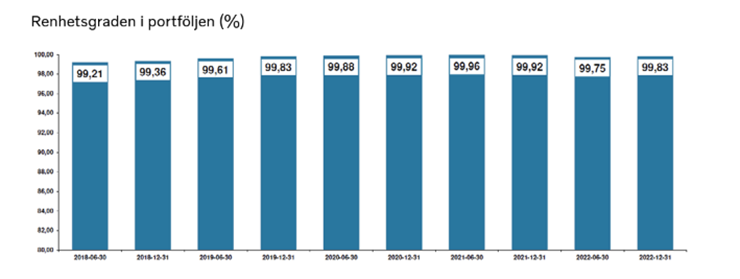

Sustainability rating of the portfolio per 2022-12-31 was 99,83%

The bars show the degree of purity every six months during the period 2018-2022.

Proportion of that part of the portfolio that does not meet the VFF Pension sustainability criteria. Review as per 2022-12-31

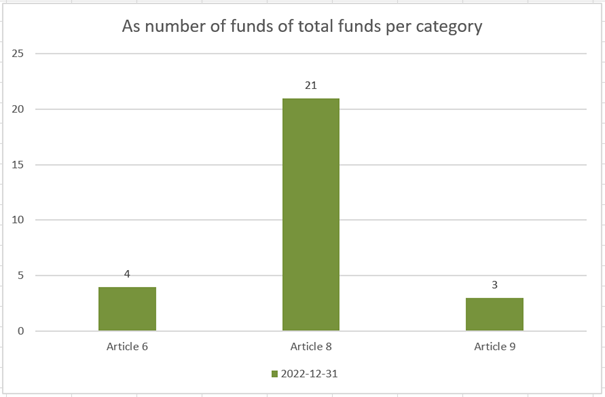

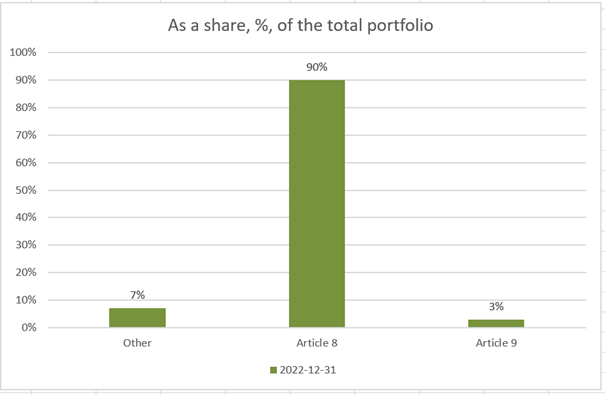

Categorization of investments according to the EU Disclosure Ordinance

The Disclosure Ordinance’s classification regarding requirements for sustainability information to be provided is as follows;

Article 8 – investments that promote environmental or social characteristics

Article 9 – investments that aim for sustainability

Other – other investments

VFF Pension’s remuneration policy

At present VFF Pension does not provide variable remuneration to employees, but if this is introduced in the future the Association will ensure that such remuneration is in strict accordance with the sustainability work conducted by VFF Pension.